san antonio sales tax rate 2020

The minimum combined 2022 sales tax rate for Bexar County Texas is 825. The December 2020 total local sales tax rate was.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

B Three states levy mandatory statewide local add-on sales taxes at the state level.

. 65 rows 2020 Official Tax Rates. 2020 rates included for use while preparing your income tax deduction. For tax rates in other cities see Florida sales taxes by city and county.

What is the sales tax rate in San Antonio Texas. Wayfair Inc affect Texas. You can find more tax rates and allowances for San.

Similarly Fort Worth central-city businesses collect taxes for the city an MTA and a crime control SPD. The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio Texas Sales Tax Comparison Calculator for 202122. Bexar Co Es Dis No 12.

Sales tax in San Antonio Texas is currently 825. These rates are weighted by population to compute an average local tax rate. City Sales and Use Tax.

Higher maximum sales tax than any other Texas counties. California 1 Utah 125 and Virginia 1. The 825 sales tax rate in san antonio consists of 625 texas state sales.

The Florida sales tax rate is currently. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The County sales tax rate is.

Within San Antonio there are around 82 zip codes with the most populous zip code being 78245. Download city rates XLSX. San Antonios current sales tax rate is 8250 and is distributed as follows.

The December 2020 total local sales tax rate was also 63750. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value. It was an overwhelming victory for both propositions.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075. San Antonio NM Sales Tax Rate The current total local sales tax rate in San Antonio NM is 63750. San Antonio TX 78205 Phone.

Did South Dakota v. The latest sales tax rate for San Antonio Heights CA. This is the total of state county and city sales tax rates.

What is the sales tax rate in San Antonio Florida. Up to 24 cash back San antonio texas. The December 2020 total local sales tax rate was also 7750.

0125 dedicated to the city of san antonio ready to. Did South Dakota v. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

2020 sqft - House for sale. The San Antonio sales tax rate is. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

The County sales tax rate is. San Antonio has parts of it located within Bexar County and Comal County. 0 Wanapum Beaches Royal City WA 99321.

San antonio city council approved on Thursday the sale of five properties it owned in. You can print a 825 sales tax table here. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 05 lower than the maximum sales tax in FL The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. The average cumulative sales tax rate in San Antonio Texas is 822.

3 beds 25 baths 1684 sq. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates. The base San Antonio Texas sales tax rate is 125 the San Antonio MTA Transit tax is 05 and the San Antonio ATD Transit rate is 025 so when combined with the Texas sales tax rate of 625 the San Antonio Texas sales tax rate totals 825.

Businesses impacted by the pandemic please visit our COVID-19 page. View the printable version of city rates PDF. 65 rows 2020 Official Tax Rates.

Comptrollertexasgovtaxesproperty-taxPage 2 50-212 07-2017 25863220660 2946060760 9822 2020 415318100 23332478000 2020 2020 22917159900. The San Antonio Texas sales tax is 825 consisting of 625. San Antonio Sales Tax Rates for 2022 San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The minimum combined 2022 sales tax rate for San Antonio Texas is. This includes the rates on the state county city and special levels. There is no applicable county tax.

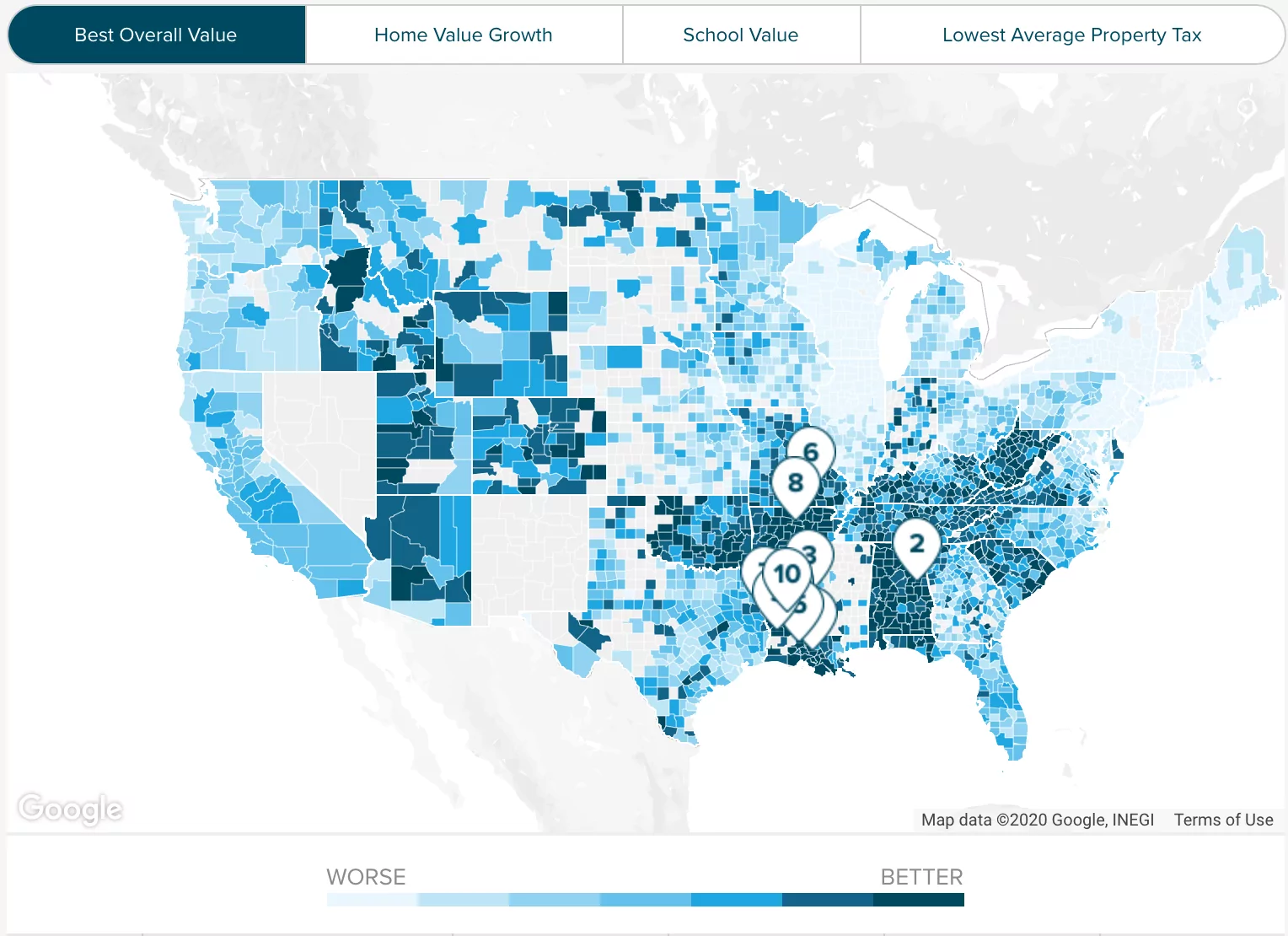

The minimum combined 2022 sales tax rate for San Antonio Florida is. Road and Flood Control Fund. State Local Sales Tax Rates As of January 1 2020.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Sales Tax Breakdown San Antonio Details San Antonio NM is in Socorro County. 2019 Official Tax Rates Exemptions.

You can print a 7 sales tax table here. 100 Dolorosa San Antonio TX 78205 Phone. A City county and municipal rates vary.

The San Antonio sales tax rate is. The Texas sales tax rate is currently. Box 839950 San Antonio TX 78283.

There is no applicable city tax or special tax. Texas Comptroller of Public Accounts. Zillow has 1945 homes for sale.

2020 Official Tax Rates Exemptions. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate.

This is the total of state county and city sales tax rates. Sport Community Venue Tax. The amount of increase above last years indigent defense expenditures is This increased the voter-approval rate by to recoup For additional copies visit.

San Antonio collects a 0 local sales tax the maximum local sales tax allowed under Texas law San Antonio has a lower sales tax than 999 of Texas other cities and counties San Antonio Texas Sales Tax Exemptions In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. City sales and use tax codes and rates. Odessa TX Sales Tax Rate.

These two tax rate components together provide for a total tax rate for FY 2022 of 55827 cents per 100 of. The Texas sales tax rate is currently. Wayfair Inc affect Florida.

Texas Used Car Sales Tax And Fees

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Which Texas Mega City Has Adopted The Highest Property Tax Rate

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Texas Sales Tax Rates By City County 2022

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Texas Sales Tax Small Business Guide Truic

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Texas Sales Tax Guide And Calculator 2022 Taxjar

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Texas Sales Tax Guide For Businesses

Why Are Texas Property Taxes So High Home Tax Solutions

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Tarrant County Tx Property Tax Calculator Smartasset

Realtor Selling House Tax Deductions Selling Your House

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Mortgage Rates Could Trend Upward Through 2020 Mortgage Rates Fixed Rate Mortgage Adjustable Rate Mortgage

Which Cities And States Have The Highest Sales Tax Rates Taxjar